An actively managed fund that is not constrained by reference to any index

Investment Research Process

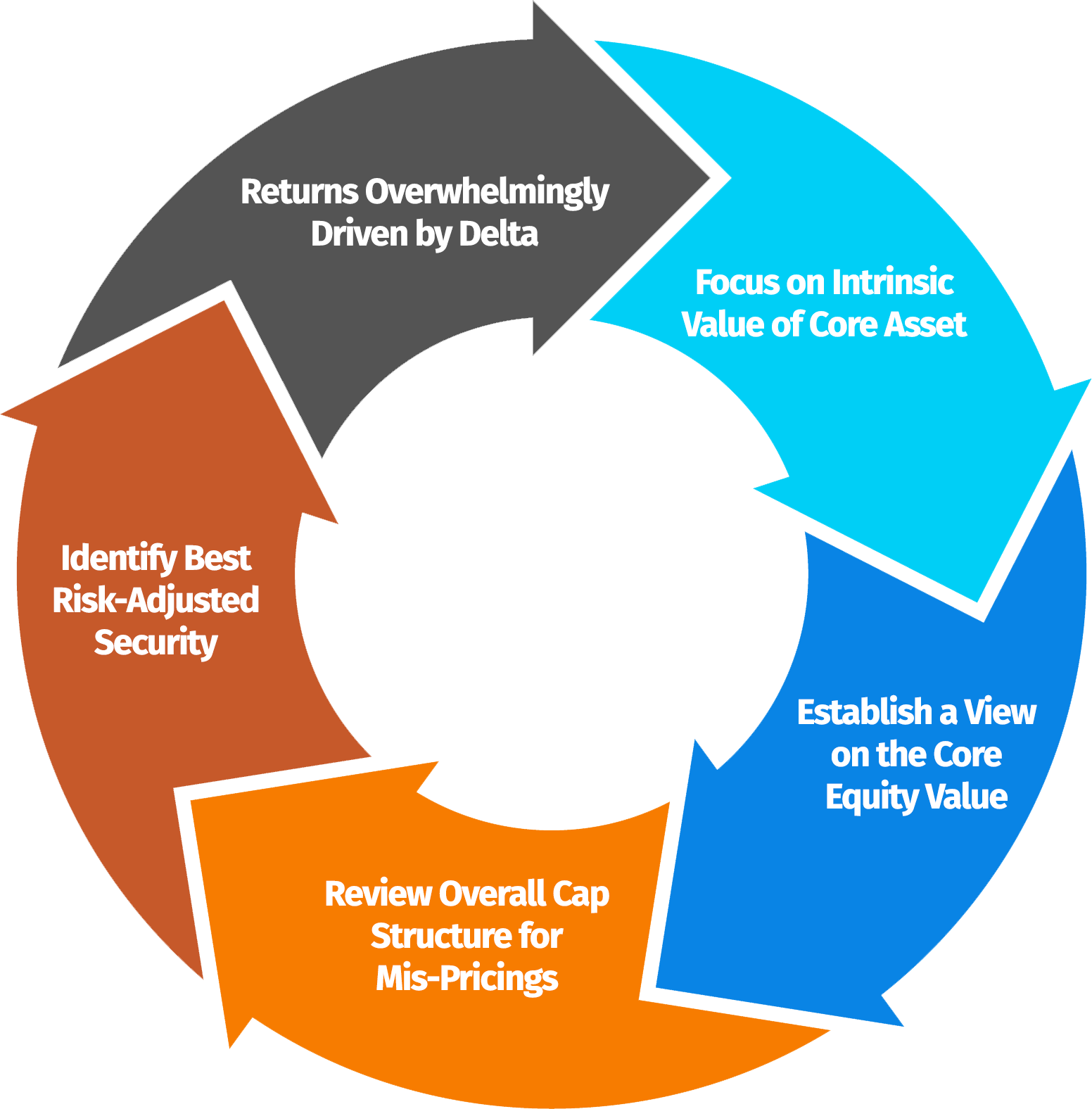

- Research Core Business: The investment team employs fundamental, qualitative, and quantitative research to understand the health of core business and potential growth prospects.

- Analyze Cap Structure: The investment team looks across different cap structures to identify potential mis-pricings in the underlying business.

- Identify Probability-Adjusted Risk/Reward: The team uses targets to determine entry and exit points through an upside / downside analysis based on normalized earnings, historical valuation rangers, underlying company business trends, and Wall Street expectations.

- Constantly Re-evaluate the Theses: The team conducts a deep fundamental analysis of 10K’s earnings reports, and various news sources as new data points arise.

Investment Strategy Execution

Industry Analysis

Understand fundamental industry trends to determine investible themes and sector allocations

Subsector Analysis

Identify disruptive themes and sector challenges to target the best growth areas

Security Selection

Leverage qualitative and quantitative methods to determine intrinsic value of a security and the opportunities across the cap structure

Macro Analysis

Understand position in economic cycle to help determine allocation between sectors and growth vs. value

Analyze Convert Profile

- Equity Sensitive

- Balanced

- Credit Sensitive

Portfolio Manager Biographies

Frank T. Timons

Sean J. Aurigemma

Related Resources

Risks

Market Risk: The risk that the market will go down in value, with the possibility that such changes will be sharp and unpredictable.

Operational Risk (including safekeeping of assets): The Fund and its assets may experience material losses as a result of technology/system failures, human error, policy breaches, and/or incorrect valuation of units. Social, political and economic developments and laws differ between regions.

Derivatives Risk: The Fund may invest in Financial Derivative Instruments (“FDIs”) to hedge against risk and/or for efficient portfolio management. There is no guarantee that the Fund’s use of FDIs for either purpose will be successful. FDIs are subject to counterparty risk (including potential loss of instruments) and are highly sensitive to underlying price movements, interest rates and market volatility and therefore come with a greater risk.

Liquidity Risk: The Fund may invest in securities which may, due to negative market conditions, become difficult to sell or may need to be sold at an unfavourable price. This may affect the overall value of the Fund.

Currency Risk: The Fund may attempt to use FDIs to hedge against currency movements, however there is no guarantee that any attempts at hedging will be successful.

Credit Risk: The Fund may be adversely affected if the issuer of a debt instrument fails to meet its repayment obligations (i.e: defaults). Convertible bonds carry additional risk as they are harder to value. There is the further risk that once such bonds are converted, the conversion may not occur at a suitable time for the Fund, or the subsequent instrument may not perform favourably.

Interest Rate Risk: Fixed income securities, including the prices of securities held by the Fund, will decline over short or long periods of time due to rising interest rates. Fixed income securities with longer maturities tend to be more sensitive to interest rates than fixed income securities with shorter maturities.